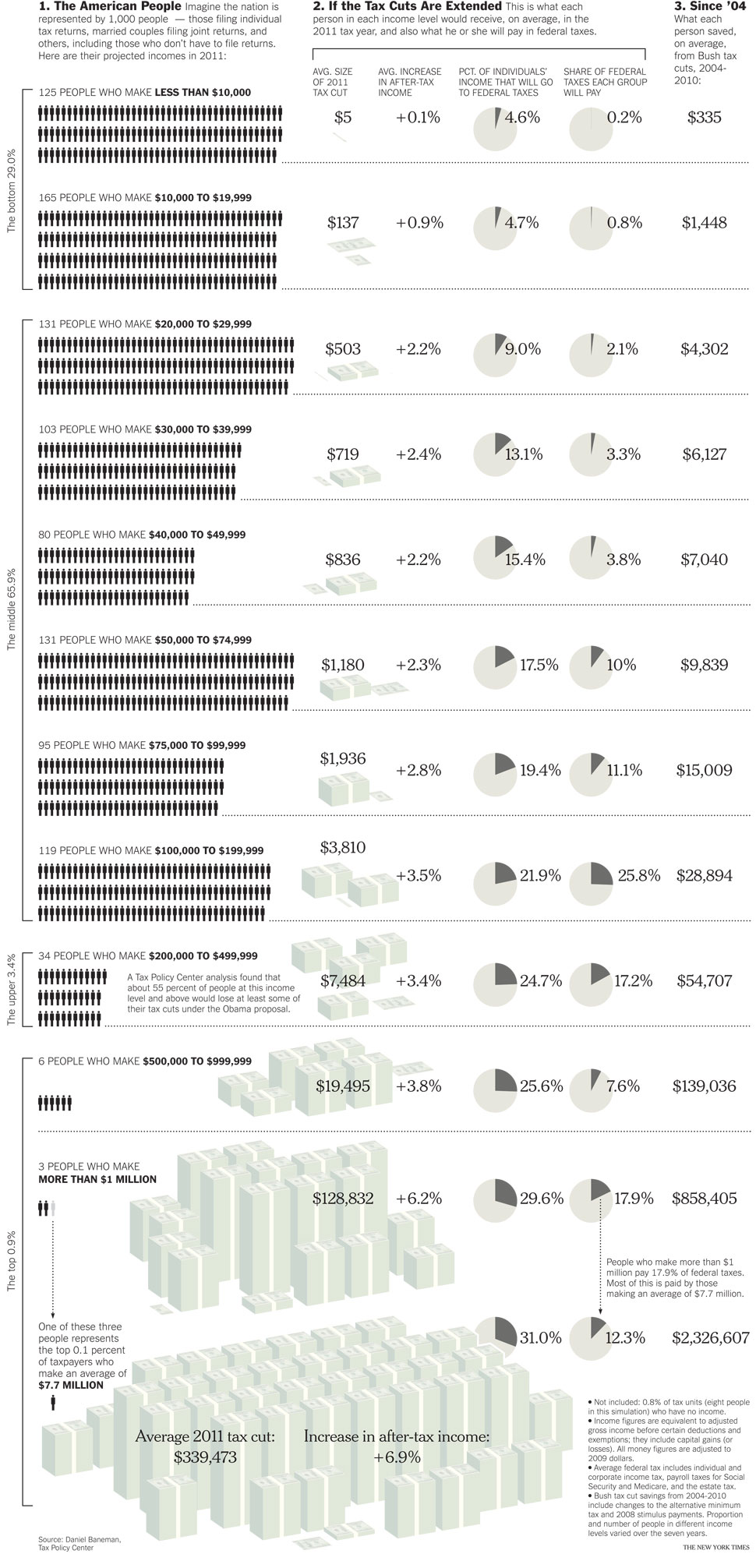

Your Coming Tax Cut (or Not)

From the NYTimes.com comes a very clean infographic look at the debate around renewing the U.S. tax cuts.

From the NYTimes.com comes a very clean infographic look at the debate around renewing the U.S. tax cuts.

The Bush tax cuts of 2001 and 2003 are set to expire at the end of this year, and the fight is on to renew some or all of them. Many Democrats want to scrap future cuts for the wealthiest taxpayers — individuals whose income after deductions is more than $200,000 and couples at $250,000 or more. The Republican leaders insist that all taxpayers should get relief, even those in the highest income strata. Wealthy Americans, they say, can use their tax savings to create jobs.

In either case, the extensions would be expensive: perhaps $2.7 trillion less for the Treasury through 2020. Here is a guide to who will get what if the cuts are extended, and who got what from the last seven years of cuts, according to an analysis by the Tax Policy Center, a nonpartisan research organization.

Found on Chart Porn

Randy

Randy

Reader Comments (1)