Payroll and Tax Deductions

Most American workers aren’t aware of the factors that determine how much is deducted from their paychecks, yet it’s important to have that understanding so you can speak up about any errors. Read more about the details of payroll and tax deductions in this infographic.

So what exactly is that payroll software deducting from your paycheck? Typical deductions include federal income tax, OASDI, Medicare tax, disability and state income tax. Your tax bracket will range from 10% to 35% depending on your amount of taxable income. Medicare tax rates will be different depending on whether you work for a company or are self-employed.

At the state level, individual states handle taxes differently, with seven states charging all residents a flat tax rate and nine other states not collecting any income taxes at all.

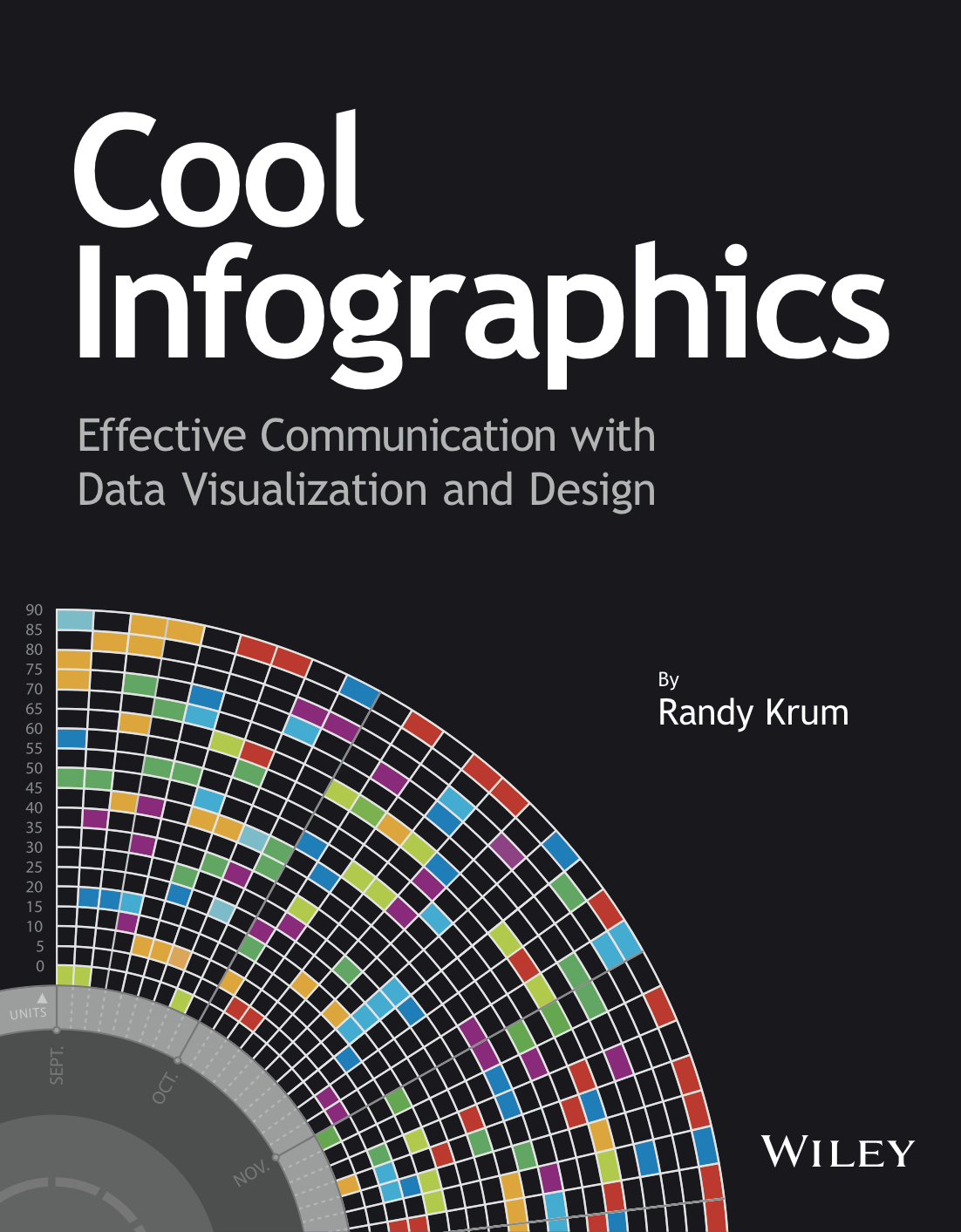

I think this is a fantastic use of an infographic to explain a really confusing and boring topic. The visual design makes it much easier to understand and the character illustration help lighten up the topic to make it more approachable by readers.

I do think the visualizations using the stacks of cash are weak. They show a size comparison between deduction amounts, but don’t visualize their specific value well. There is also still more text than I would like in the design, but with this topic you do have to be clear and precise because the tax laws are so complicated.

At the bottom, the design is missing the URL for the original landing page, a copyright statement and any credit to the designer.

Thanks to Matt for sending in the link!

Randy

Randy

Reader Comments (1)