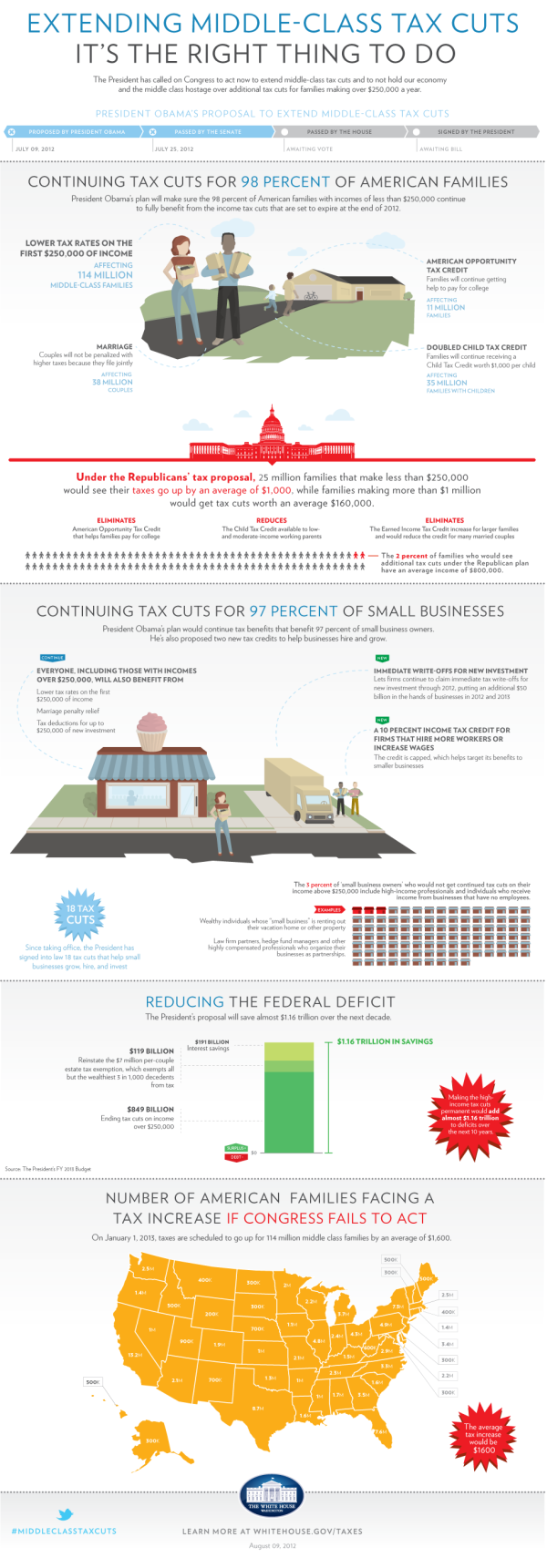

White House Infographic: Extending Middle Class Tax Cuts

Here is a new infographic from the White House illustrating why Obama’s plan to Extend Middle Class Tax Cuts is the right thing to do. The infographic points out the pro’s for why it should be passed and what will happen if it isn’t passed. I’m certainly not pushing a political bias, but I thought it would helpful to take a close look at some issues with the design.

From the White House:

Unless the the House of Representatives takes action before January 1, 2013, a typical middle-class family of four will see their taxes go up by $2,200 in the coming year.

President Obama is fighting to prevent that from happening. He is pushing lawmakers to get this done.

What we should do right now is give middle-class families and small business owners a guarantee that their taxes will not go up next year,” he said. “When families have the security of knowing that their taxes won’t go up they’re more likely to spend, and more likely to grow the economy. When small business owners have certainty on taxes and can plan ahead they’re more likely to hire and create new jobs. And that benefits all of us.” – President Obama

A few thoughts:

- I like the progress bar design to visually show the current status of the issue.

- Overall, the text is very small. Even when viewing the full-size resolution version on the landing page, some of the text is hard to read.

- Sources are only listed for one statistic the Reducing the Federal Deficit section. Where does the rest of the data come from, and why should we believe it?

- Visualizing the stats in the first section would have been very helpful to put the numbers into context. They should show the reader that 114 Million Middle-Class Families is a certain percentage of the total number of families in the U.S.

- Nice use of red color to show the opposing proposal. From a design standpoint, red = bad/negative so this visually shows the opposing plan with a subconscious negative bias.

- The visualization of 100 people icons is correct, but would be easier for the reader to understand if it was organized in rows of 10. Our number system is Base-10, so that’s how readers understand data.

- Again, the rows of 15 small office buildings are hard for the reader to understand. They should be rows of 10 to be immediately understandable.

- The U.S. map should be display the values as a heat map. States with higher values would have full color, and states with lower values would have lighter shades of the same color in accordance to the values. Don’t make the reader read all of the text values and hunt to figure out the higher and lower values. You don’t want to make your readers work that hard, when you can visualize it easily for them.

- The “Learn more…” statement at the end is a good call-to-action at the end of the infographic, but they should also include the URL of the infographic landing page so people can find the original.

The White House has been experimenting with infographics for about a year now. You can see my thoughts about two previous examples of The Obama Energy Agenda and The Resurgence of the American Automobile.

What do you think about the design? What do you like, or would have done differently?

Found on the White House webpage

White House,

White House,  design,

design,  money,

money,  presidential,

presidential,  taxes

taxes

Reader Comments (2)