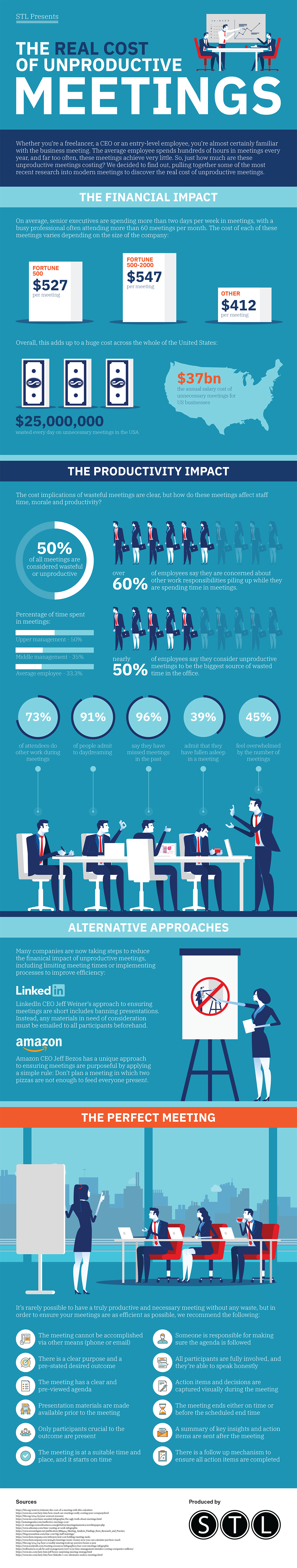

The Real Cost of Unproductive Meetings

Meetings are important to a companies success no matter what the size; however, unproductive meetings can be extremely costly. STL produced The Real Cost of Unproductive Meetings infographic as a guide to help put on the most effient meeting possible to avoid a large financial impact.

They're not only far-too-frequently used and often a little bit dull, but those corporate meetings could be costing your business thousands (or even millions) every year.

A study by Bain & Company back in 2014 found that 15% of a businesses' time is spent on meetings, and that number has been increasing steadily for many years. Given the value we place on this time, how much of it is actually productive?

For our latest infographic, we decided to take a look at the true cost of meetings, and present a formula for the perfect meeting - so, if you simply must hold one, at least you can make sure it's as productive and cost effective as possible.

Overall, a good infographic with some good data and information.

However, I take issue with how some of the data is visualized. In the Financial Impact section, vertical bars are shown to represent the cost of meetings. These bars don't accurately represent the values being shown with the $12 bar half the height of the $527 bar. Either the design just eye-balled the size of the bars, or this is a non-zero baseline bar chart that starts somewhere around $300. This is cvisually misleading to the audience, especially when the scale isn't shown.

The footer infomation is missing both a Copyright (or Creative Commons) license and the URL to either the company or the infographic landing page is missing. How are readers suppsed to find the original post?

Thanks to Dave for sending in the link!

Randy

Randy