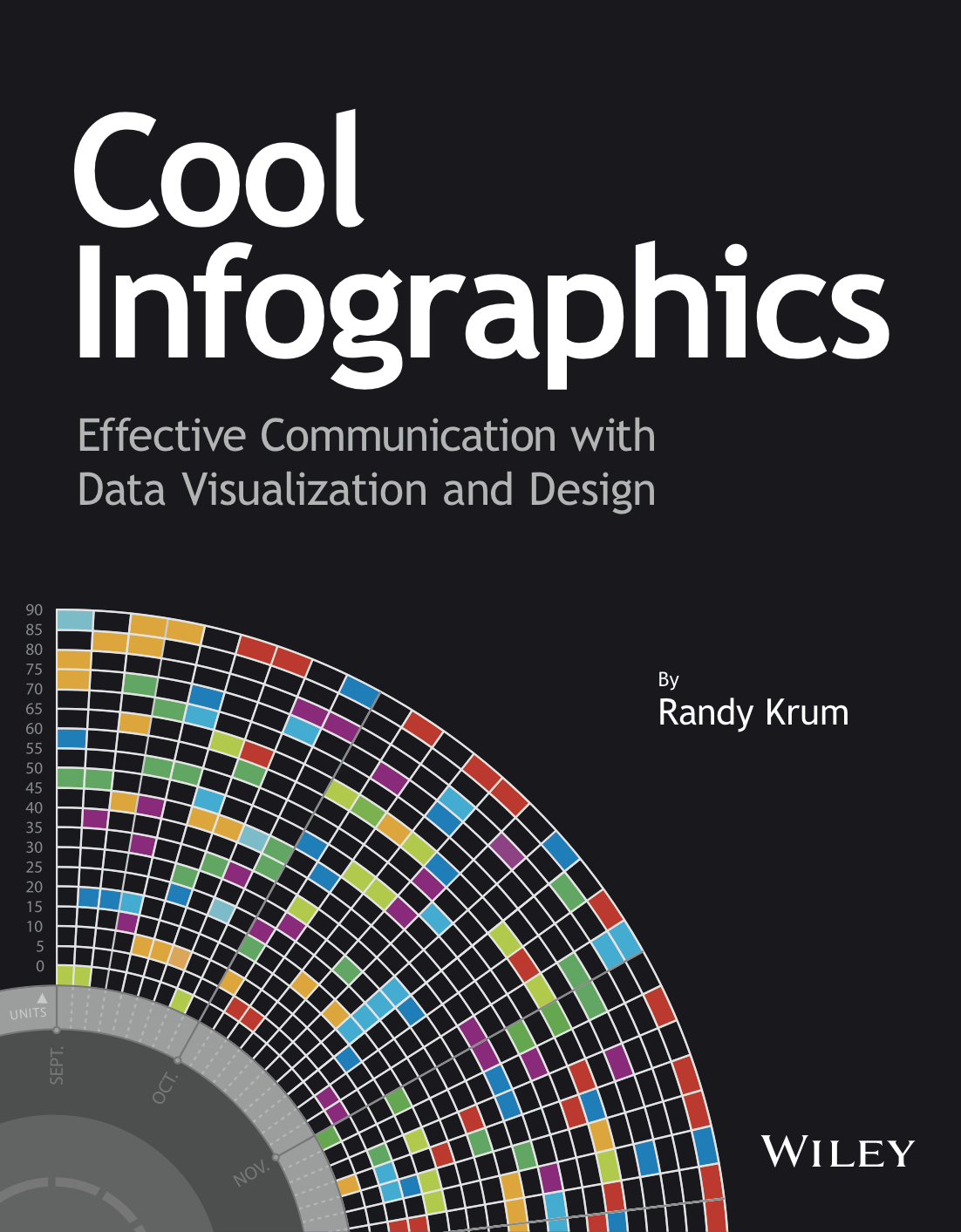

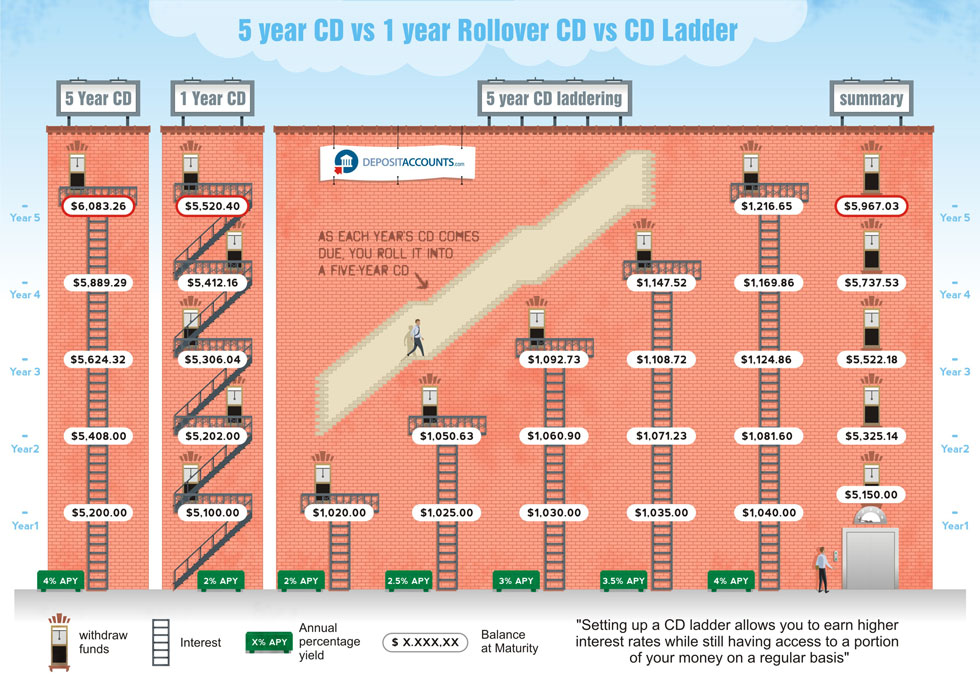

CD Laddering Investment infographic

Designed by Derri Hasmi for DepositAccounts.com, this CD Laddering infographic does a great job helping to explain the investment theory of CD laddering as compared to investing in standard CDs.

CD laddering is a strategy that allows you to take advantage of the higher cash rates offered by CDs, while at the same time ensuring that you have access to your money regularly. The most common type of CD ladder is the five year ladder. In this scenario, you open five different CDs. Let’s say that you check your savings account, and you have $15,000. You want to keep $5,000 for emergency purposes (move it to a high-yield savings account if it isn’t in one already), but use the remaining $10,000 to get your CD ladder started.

Thanks Jeremy!

Randy

Randy

Reader Comments (5)

You need to look at the variability of returns compared with their mean returns over various time scales.

If you look at the distribution of day-to-day returns for the S&P 500, it’s very wide compared to it’s mean. If you look at year-to-year returns, it’s much, much narrower. If you stretch the period to 3 or 4 years, it looks fairly safe to me. And for retirement savings, you’re usually looking at decades.

If you fix the standard deviation of the final result, the mean return rises with the time horizon.

How far you push towards that 12% depends completely on your time horizon.

http://investmentsupport.co.uk

Investment Support

Cool infographic! Here's another one I really liked. Hope you like it too!