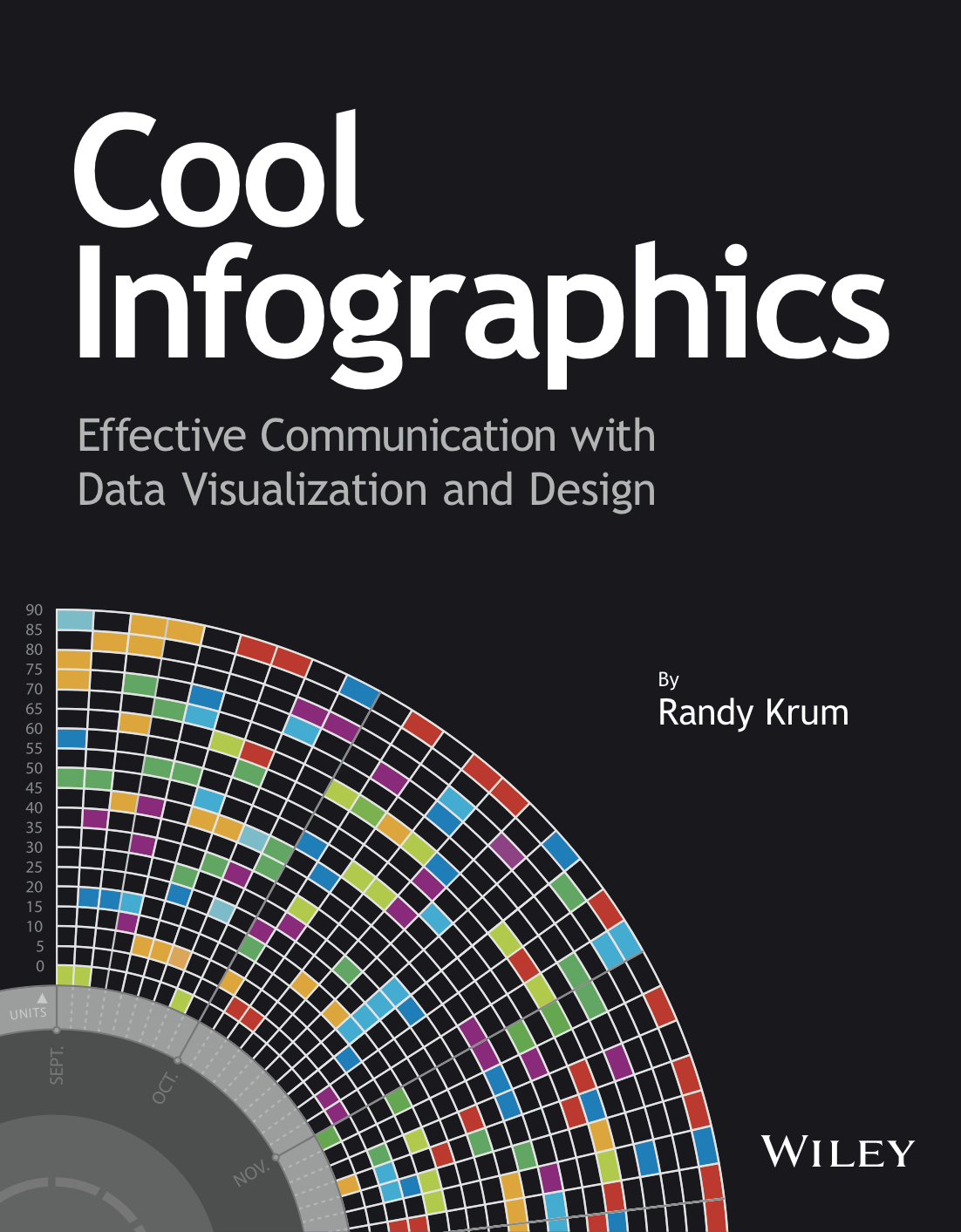

Visualizing Tax Brackets

Steve and the infographic team from WeatherSealed.com bring us this great infographic that visualizes the historical U.S. income tax brackets.

Yes, in the 1950’s and 1960’s the top tier tax bracket was a staggering 90%!

To illustrate, Weather Sealed’s infographic team charted the historical U.S. income tax brackets for singles, adjusted for inflation, from 1910 to present. The colors indicate the marginal tax rate: black for low, red in the middle, and yellow for high. The horizontal axis is the tax year, and the vertical represents taxable income, log-scale, normalized to 2010 dollars with the Bureau Of Labor Statistics’ monthly CPI-U figures. The bracket data comes from The Tax Foundation and the IRS, and the effects of Social Security, capital gains, AMT, and other tax varieties are not included.

Found on ChartPorn.org and VisualizingEconomics.com

Randy

Randy

Reader Comments (5)