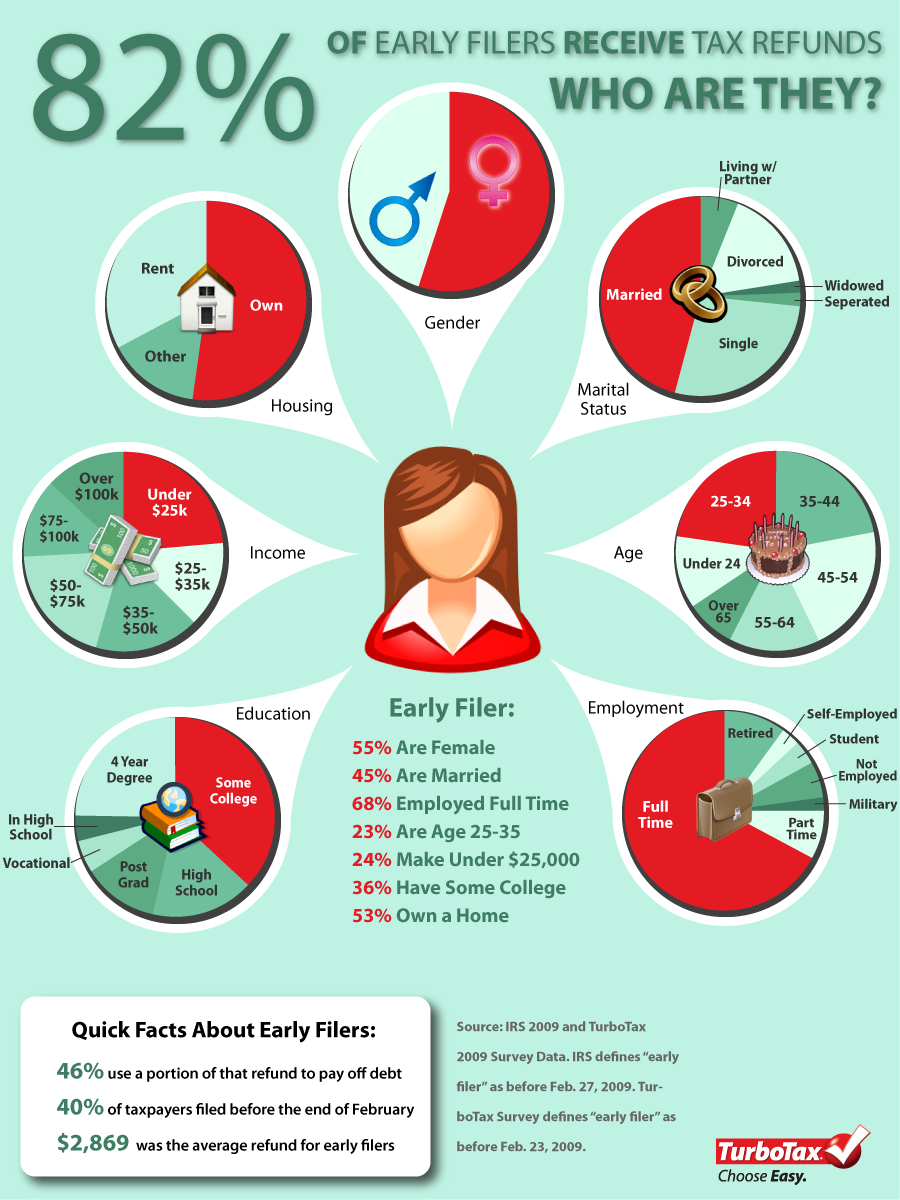

Early-Bird Taxpayers Get the Refund - infographic

$2,869 was the average refund for early filers in 2009 based on this infographic from TurboTax. Designed by Column Five Media for Intuit.

Are you an early bird or a tax procrastinator? Did you know that people who file their income tax returns in February are among the most likely to get refunds – and larger ones at that? TurboTax reports that 82% of taxpayers who filed before the end of February last year got money back, and on average, the refund for early filers is typically larger: $2,869 compared to $2,753 for returns filed through April 15th last year.

Forty percent of all tax returns last year were filed before the end of February. That means 60% missed out on some of the benefits of filing early such as putting money in your pocket faster – making your refund work for you.

Although I’m not a fan of the overuse of pie charts, I think it works in this case. The infographic doesn’t have so many pie charts that it becomes confusing, so its very easy to wrap your head around who this typical TurboTax, early-filier consumer is.

Thanks Laura for the link!

Randy

Randy

Reader Comments (3)

It seems to me that people file early because they know they are getting a refund and they want it ASAP. People who know they are going to pay will wait for the last minute to file. Wouldn't that be the reason why people who file early average more money?

I gree with Les, the timing of when you file has nothing to do with how much you get in return. The #'s dont change. The motivation is the only difference.

Great blog, just discovered it recently.

And yes, I also filed my Quebec income tax return early since I knew I was getting a refund, and my federal (canada) income tax I am waiting as I owe money. Taxes are a math formula, filing early or late wont change those amounts.